No matter how much money you have, you can always be smarter with it. You don’t need an M.B.A to be financially savvy. You got this!

1. Swear Off Plastic

Avoid swiping your credit card, but how to change the habit? First of all, you need an envelope and a notebook. At the beginning of the week, you’ll tuck your designated monthly spending money into an envelope. Then for the next seven days, all purchases would have to come from this stash of cash and you need to record them. Sounds easy, right? In fact, it works. Research has shown that the mere act of giving something tangible up, like dollar bills, makes you likely to spend less than you would when swiping a credit card.

In doing so, you inevitably save yourself from overspending and make wiser purchases with your credit card. But don’t get me wrong, using a credit card isn’t bad, but you got to keep an eye on it. You work hard for your money, so it should make you confident and happy, not wake you up panicked in the middle of the night.

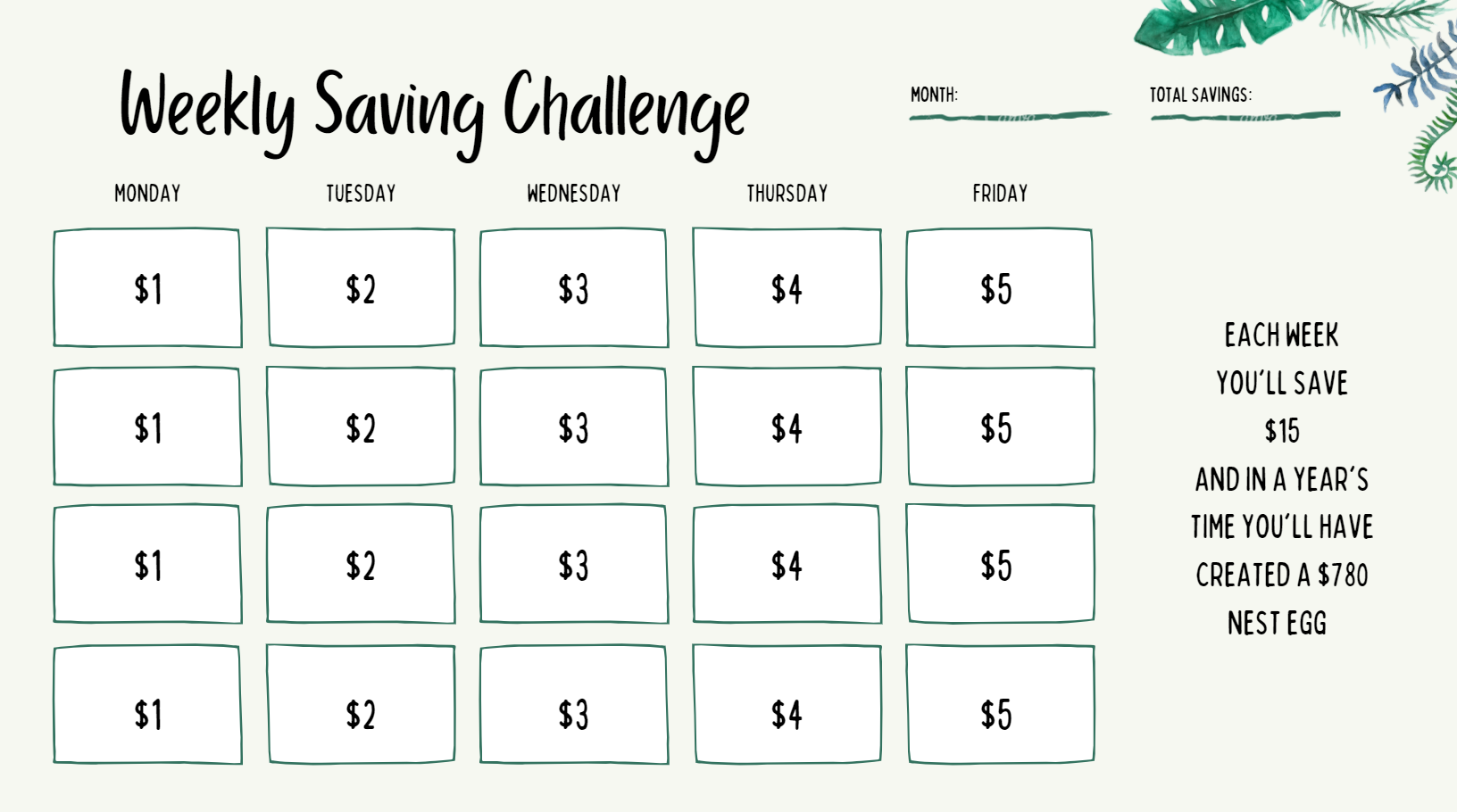

2. Try the 52-Week Challenge (Easiest)

The most painless way to start saving. Parents, this is a good challenge for your kids. Starting with $1 and saving just $1 more each week, it may not seem much, but you have would $1378 in a year.

Alternatively, start with a daily saving plan to watch your spending habit, but you can let yourself off on weekend. You can then put the savings into an investment plan to make your money work harder.

3. Name Your Savings Account

If you label your online accounts to reflect your goals – like “New Home” or “University” – you’ll save more than if you had a catchall fund.

4. Pay Yourself for Scoring A Deal

Before making a purchase, it is always good to figure out if there’s an upcoming sale or promotion. You pay yourself for scoring a deal by identifying the difference between the full retail price of an item and its sale price into savings. For instance, when your favourite designer dress has been marked down from $50 to $30, go ahead and buy it – but transfer the $20 into savings account.

5. Time Your Purchase

If you wait to purchase something until you need it, you’re likely to pay the sticker price, but with a little advanced planning, you can save some cash. Look out for end-of-season sales, monthly deals and promo codes!

Black Friday Sales are usually a good time to score big-ticket items.

(Get it by Changi Recommends is having a Black Friday Sale – use <BLACK12> to enjoy 12% off with no minimum spend!)